Visit Our Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expect to see some major changes in the United States’ relations with its trading partners in 2021, especially China. In this conversation with SupplyChainBrain Editor-in-Chief Bob Bowman, Patrik Berglund, founder and CEO of Xeneta, speculates about which trade policies implemented by President Trump will be reversed under the new administration, and which will be retained.

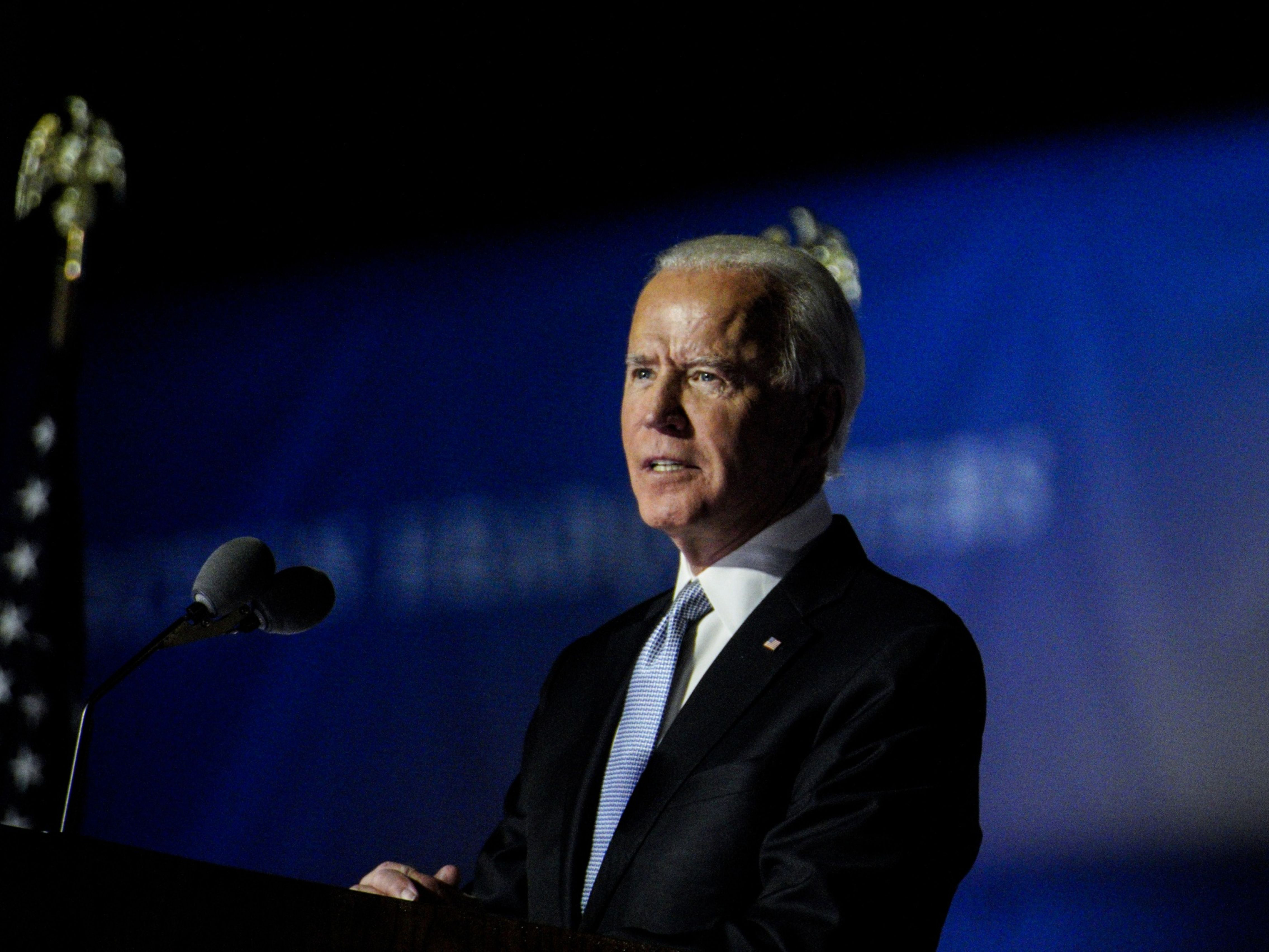

SCB: Looking ahead to the Biden administration's U.S. trade policy, what moves taken by the present administration do you expect President Biden to reverse?

Berglund: Overall, I think they're going to take a much softer stance to all foreign nations when it comes to trade. They’ll look to smooth over all those relationships a bit, and make sure the U.S. comes across as a more stable partner again, one that's predictable in the longer term. That's been one of the main issues I’ve picked up on over the last four years, that business has really struggled with the unpredictability of the Trump administration. That doesn’t mean I'm debating whether they did something right or wrong. But any trading partners, whether they’re supplying the U.S. with raw materials or finished goods, would be looking for more predictability and stability. I think that's what the new administration will seek to establish.

SCB: What actions that the previous administration took do you expect the new one to keep?

Berglund: Biden is looking to be the president for everyone. It’s not about Democrats or Republicans. So I think he's a little bit stuck. He can't just reverse everything. And given the status of the economy, there will be an appetite for the U.S. to strike better deals than it has historically. That's a little bit of what Trump has put on the agenda. There are more new eyes on all these deals, in terms of how beneficial they are to the U.S. economy.

SCB: How do you think the U.S. relationship with China will change?

Berglund: I the Biden administration will set a completely different tone. The U.S. economy and big corporations are so dependent on supply coming from China. And the new administration will have less of an appetite to be provocative toward the Chinese. That’s the main difference — there will be a much friendlier tone. At least that’s how it looks on the face of things. It’s aligned with what U.S. business, especially technology companies, would like to see from this new administration.

SCB: Do you think the Biden administration will generally pursue multilateral trade agreements over bilateral ones? Will Biden return to our previous policy of encouraging multilateral cooperation in trade?

Berglund: If you take a step back and look at what has happened over the last 70 years, the world has gotten more and more interconnected. Everybody's trading and dealing with everybody, both for simple products like a jacket or more sophisticated ones like an iPhone. If you look at the origins of the different components going into that, and who's trading with whom and sending what where, it's so connected. Whatever type of agreement they strike, whether multilateral or not, I don't see that trend being reversed.

SCB: What impact do you think these potential changes in U.S. trade policy will have on freight rates and carrier services for international freight?

Berglund: It's the craziest sort of unpredictable time to even be asking that question. I'm sure you picked up on what's happening on the trans-Pacific eastbound route, with rates on containerized freight skyrocketing. Basically, all outbound Far East rates have peaked either to an all-time high, or their highest in five to 10 years. It's a market that’s completely in flux. I haven't seen anything like it for the last 15 years. We’re also witnessing a major transition in consumer consumption, from spending less money on travel and services to more on physical products.

SCB: What impact is that trend having on sourcing patterns?

Berglund: What this has created for businesses is a bigger desire for resilience, supply-chain contingency planning, and risk mitigation. There’s a big conversation now about whether this could be the end of single sourcing. Take a U.S. importer that has been getting all of its products from China. Maybe that now becomes 70% China, 20% Eastern Europe and 10% South America, just to have more flexibility and resilience in the supply chain in case of political instability, pandemic or natural disaster. At the same time, there’s a big capacity crunch.

SCB: Is some of this due to ocean carriers canceling a number of sailings during this year, reducing the overall amount of capacity and thereby driving up rates?

Berglund: Absolutely. That was the first thing that happened. When China shut down in February and March, carriers were scared. They were scrambling for all the possible actions they could take. That's when they started blanking sailings. I've never seen them as quick and efficient about it as they were this time around. In the beginning of the year, we speculated who was going to go belly up because of the coronavirus. Because traditionally, carriers have made it a race to the bottom, trying to pick up any cargo that's out there at any given rate, and then rates have collapsed. This time around, they've very swiftly pulled out enough capacity from the market to create a completely reverse effect. Then as cargo volumes have reappeared and even increased compared with last year, they’ve created this crunch.

Now Chinese authorities are intervening, trying to cap rates on trans-Pacific eastbound. U.S. authorities have said they'll keep an eye on it. And the shippers’ council in Europe has said it’s looking at those rates, questioning whether what carriers have done is legal market behavior. You also have another dimension, with empty containers ending up in the wrong locations. There should have been a better balance between where the empty boxes were located and where they were needed. That's one of the factors that is also pushing up prices. There are serious questions being raised about whether carriers are behaving the way they should be behaving.

RELATED CONTENT

RELATED VIDEOS

Timely, incisive articles delivered directly to your inbox.