The coronavirus pandemic has hit global supply chains hard. Consumer fear has led to the hoarding of everything from toilet paper to bottled water, and companies that supply meat, vegetables and other staples are struggling to meet in the surge in demand.

The consumer packaged goods industry is ramping up production, and some retailers have responded by limiting purchases of high-demand items. Businesses in these sectors shouldn’t wait for the crisis to settle to evaluate what they should do to plan for, and mitigate against, future supply-chain disruptions.

The solutions that have worked in the past — increasing inventory, adding capacity at different locations and diversifying suppliers — may reduce risk. But those tactics are just scratching the surface when it comes to having a truly resilient supply chain.

The COVID-19 crisis could be a tipping point in the transition to new technologies to power supply chains. A sea of innovative digital platforms and applications has emerged in the last few years that help establish an interconnected network of what today are largely discrete, siloed supply-chain steps. A digital supply chain increases transparency and responsiveness because every activity is able to interact with one another in near real-time.

We have assessed adoption rates of six current and emerging digital technologies:

- Artificial intelligence, machine learning and big data

- Blockchain

- Internet of things

- Collaborative robots (cobots)

- Geospatial analysis

- Digital twin

While other sectors are well advanced in adopting digital, CPG is somewhat behind the curve. Despite all the talk about digital transformation, the penetration of key technologies throughout the CPG supply chain — from product development to manufacturing to consumer management — remains superficial. Only one in four CPG companies have embraced at least one digital solution across one or more components of their supply chains.

Early adopters, though, of AI, ML, big data, IoT and blockchain demonstrate the value of these technologies. Procter & Gamble uses digital platforms that help automate supply-chain planning. Traditional planning tries to match demand with supply for the next 30 days. The problem with this process is that a lot of things can change in a month, or even a week. Storms might delay deliveries. Retailers might want to do special promotions to coincide with a high-profile sports event. A supplier glitch or product shortage might come into play without forewarning.

Today’s fast-moving markets spurred P&G to take a new look at demand planning. The company’s planners are now supported with machine learning algorithms that automatically adjust demand plans for new product launches, changes in stocking strategies or seasonal shifts. The aim is to improve productivity and accuracy, and free planners from cumbersome, often manual tasks.

The digital tools allow P&G to do demand planning for products like Tide detergent multiple times a day, according to a Forbes article about the company’s supply-chain planning. This sort of agility can open new opportunities and save companies significant money. Market intelligence shows that digital tools can automate 80% to 90% of supply-chain planning.

Other companies are implementing IoT technologies, such as GPS and radio frequency identification devices, that make it easier to identify and track items in warehouses and stores. They capture real-time data on variables such as temperature and humidity in facilities, as well as speed of delivery. Research shows that digital technologies can help reduce inventories by up to 75%, while still allowing suppliers and customers to find the right product at the right time.

The most innovative technology in supply-chain management, though, is still being explored by CPG companies. Digital twin technology creates a digital replica of physical assets, people, places, systems and devices. Wouldn’t it be great if you could build what-if scenarios for the products, facilities and processes you wish to change in your supply chain before you start the project? That’s the promise of digital twins. But the ease of implementation is low, because creating virtual models of highly complex systems requires existing use of connected sensors and advanced analytics.

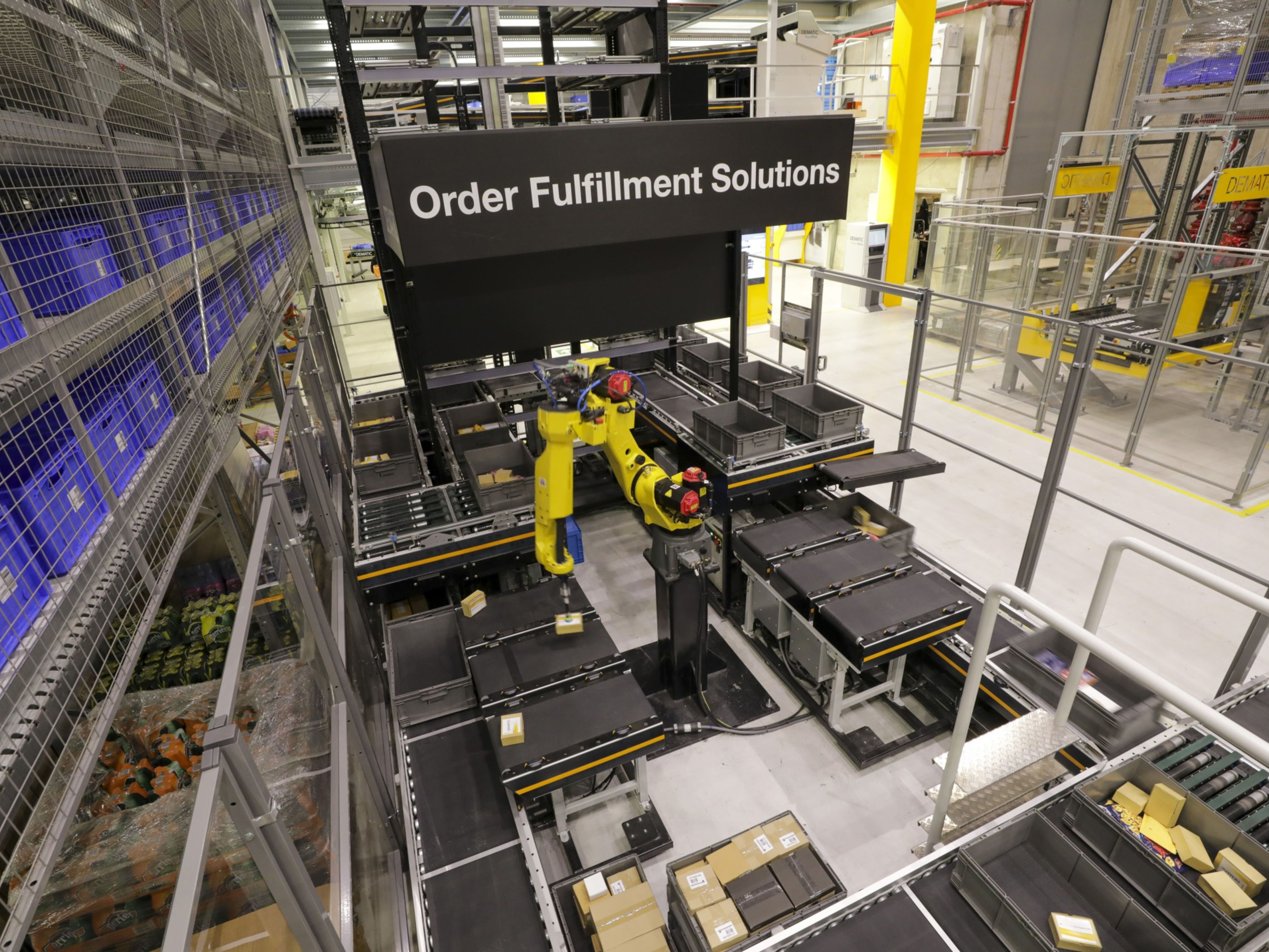

While recent technology advances play a critical role in the digital transformation of the CPG sector, there are many legacy technologies at the other end of the innovation scale that have been overshadowed by AI, ML and other emerging solutions. Cobots, for example, have been around for decades, and are of significant value to CPG supply chains.

Unlike robots, which traditionally are isolated from workers and are programmed to follow specific instructions without human interference, cobots operate in cooperation with humans in a shared workspace. The first examples emerged in the mid 1990s from university research projects and the General Motors Robotics Center, in which humans would provide the power to make the machines move while the cobots would provide the control and steering to place objects with precision, according to Forbes.

Today’s cobots are equipped to help CPGs fill labor gaps, maximize a smaller footprint, and mitigate worker safety and product contamination risks.

One of the early adopters in CPG has been Amway, the world’s largest direct seller. Jeff Kirn, a manager in the company’s project engineering, told The Association for Packaging and Processing Technologies: “Our primary driver in pursuing cobot applications was to help alleviate stresses in our manufacturing operations from labor shortages. Not only did cobots address our labor issue through automation which increased productivity, but we have realized a significant reduction in direct labor costs.”

In addition to skilled labor shortages (prior to the coronavirus outbreak), other forces driving cobot adoption are the global increase in product demand and the growth in e-commerce. In the era of two-day delivery, cobots can help make warehousing, logistics and fulfillment more efficient.

Geospatial analytics, or location intelligence, is crucial for decision making. Cargill uses geospatial analysis and satellites to monitor its supply chain in Brazil, and suppliers’ adherence to the Brazilian Forest Code and farm registration system.

The coronavirus outbreak will force companies that have been slow to adopt digital tools to reconsider the benefits. The crisis demonstrates the need for accurate, real-time information that can help businesses make better-informed decisions. While many disruptions can be beyond a manager’s control, companies can still prepare for them. Reconfiguring supply chains doesn’t always improve the flow of information if silos still exist.

Disruptive risks require investment in additional supply-chain resilience even though the gains and ROI might not be immediate. Companies should be considerate of the time required for digital technology to be implemented and stabilized before it starts reaping benefits, which include:

- 50% to 75% reduction in lost sales,

- 30% lower supply-chain administrative costs,

- 30% reduction in logistics costs, and

- 3% to 5% increment in annual earnings growth before interest and taxes.

The journey to a digital supply chain won’t always be easy. But successful organizational change, much like social change, can be influenced by the people and capabilities around us — be that stakeholders within your business or supply partners — as well as how external intelligence and internal data are used to make better business decisions.

As author Malcolm Gladwell concludes in his book The Tipping Point: How Little Things Can Make a Difference: “In the end, Tipping Points are a reaffirmation of the potential for change and the power of intelligent action. Look at the world around you. It may seem like an immovable, implacable place. It is not. With the slightest push — in just the right place — it can be tipped.”

Ashish Rastogi is vice president of client solutions at The Smart Cube.