The generation between the ages of 15 and 25 will sooner or later change the world of fast fashion.

In recent years, brands such as H&M and Zara have dominated the market with their vertical approach to manufacturing and retailing. However, companies such as ASOS or Boohoo are now expanding into this segment. The latter have one thing in common with the old players: they’re sprinters. According to a report by Coresight Research, the time between design idea and delivery of garments today can be as short as two weeks, and at most a month.

At Zara and H&M, however, the product cycle typically exceeds one month, depending on product and manufacturing site. And many traditional apparel retailers still have turnaround times of up to six months. But it’s the super-fast clothing specialists of today, supported by high-performance logistics, that are proving to be the most financially successful.

Why are these new stars of fashion enjoying such success? Following are four possible answers.

Ultra-fast companies know their customers. They observe their target group closely and only deliver what’s currently en vogue — and that in almost no time at all. If, for example, Instagrammers mark red skirts or trousers with leopard print with "likes," young buyers don't have to wait two weeks to order their new favorite online. Some designers follow the live stream of big fashion shows and create the first designs virtually in real time. In the past, trends from catwalks usually wouldn’t hang in customers' wardrobes until the following year. The fastest merchandisers today don’t produce masses of garments all at once, and push them into the market. Often they’ll make only a small amount of product and re-produce the bestsellers in variants. The thinking is: Why produce brown skirts at all, when the majority of customers prefer red and yellow?

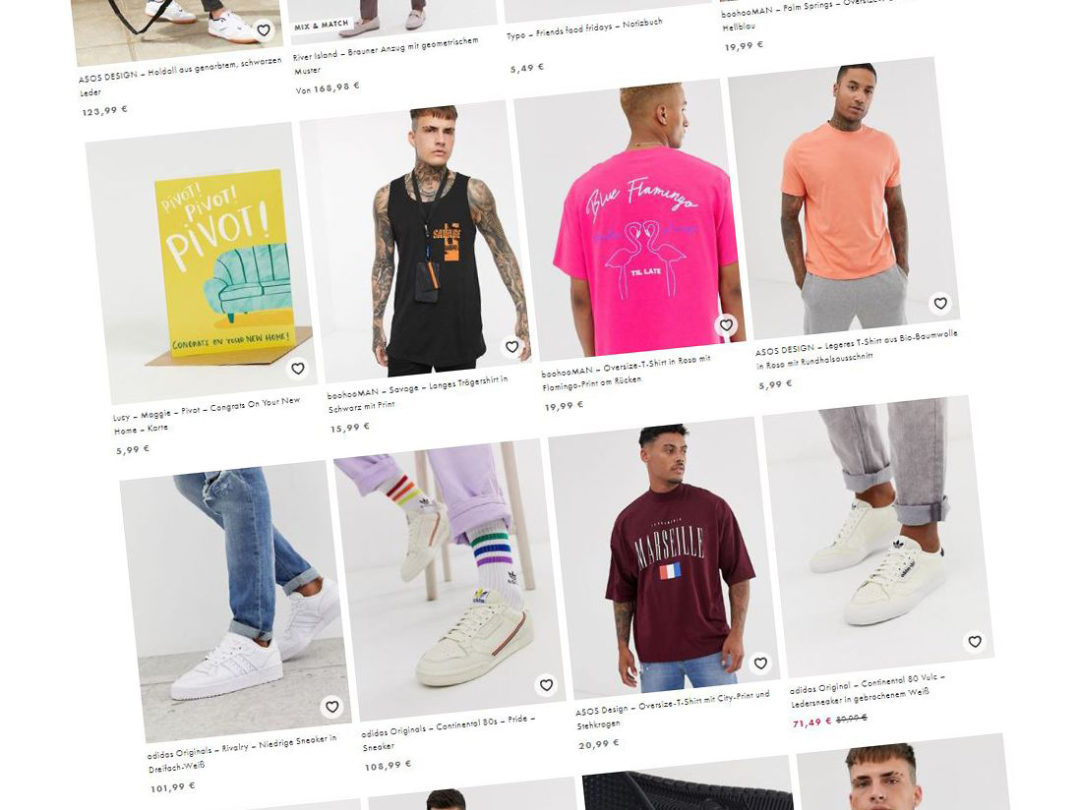

The super-fast are limited to online channels. In contrast to the old players of the fast fashion world, the fastest companies today don’t own a single shop. Instead, they flood the web with offers. The British provider ASOS — the name stands for As Seen On Screen — has more than 4,000 offers per week. Those who don't have to serve a stationary trade have a big advantage. The supply chain becomes shorter and can easily be accelerated with the help of modern software, automated logistics and fast transports. Moreover, the young talents in the industry are using another trick: they’re already putting online garments that are still on their way from the factory in Asia to Europe.

Those who are fast rely on modern technologies. These companies are turning all the screws to bring the supply chain up to the state of the art. That costs money. But investment is the prerequisite for the super-fast business to work at all. It calls for the use of highly automated bag sorters, along with modern supply chain software to achieve transparency in the supply chain and control suppliers, agencies and forwarders in real time. The players work together on a central platform and thus always have an overview of customer orders, along with the dates when certain steps must be completed. Only in this way can a short-term production change be passed along quickly and accurately.

Some of the pacesetters produce in their home countries. Boohoo from Manchester produces around half of its clothing in the United Kingdom. Wages are higher there than in Asia, but the additional expense is offset by the advantage of speed to market. In the process, slow-moving items that can only be sold with high discounts, which threaten to weaken the brand, are kept within limits.

Price isn’t the decisive factor for companies aiming to fulfill the modern-day customer's wishes instantly. Boohoo offers simple t-shirts starting at €10; H&M sells them for half that price. In order to serve customers extremely quickly, ultra-fast companies sometimes have to pay more when it comes to transport. Even a piece of clothing that goes for just €40 is is sometimes flown in an air cargo plane.

Such a means of transportation isn’t sustainable, and neither is the ever faster pace of consumption. But when compared to traditionalists, ultra-fast companies don’t dispose of large numbers of unworn garments. They know their customers' preferred products very well — and only those exact products end up being produced.

Ralf Duester is co-founder, CEO and president of Setlog Corp., a provider of supply chain management software.