There’s no indication that supply chain disruptions will ease in 2022 as bottlenecks, labor shortages and capacity crunches remain widespread. Under its zero-tolerance COVID-19 measures, China is bound to shut down production and ports more frequently as the ultra-contagious Omicron variant spreads. Meanwhile, U.S. consumers continue to demand more and more stuff. And brands are determined to deliver on time and delight — or at least not disappoint — customers.

While no one can say when supply chains will normalize, we can predict how shippers will adapt in 2022. Let’s start by examining the data on container shipping, then move to the short- and long-term options currently circulating in boardrooms.

Still Waiting

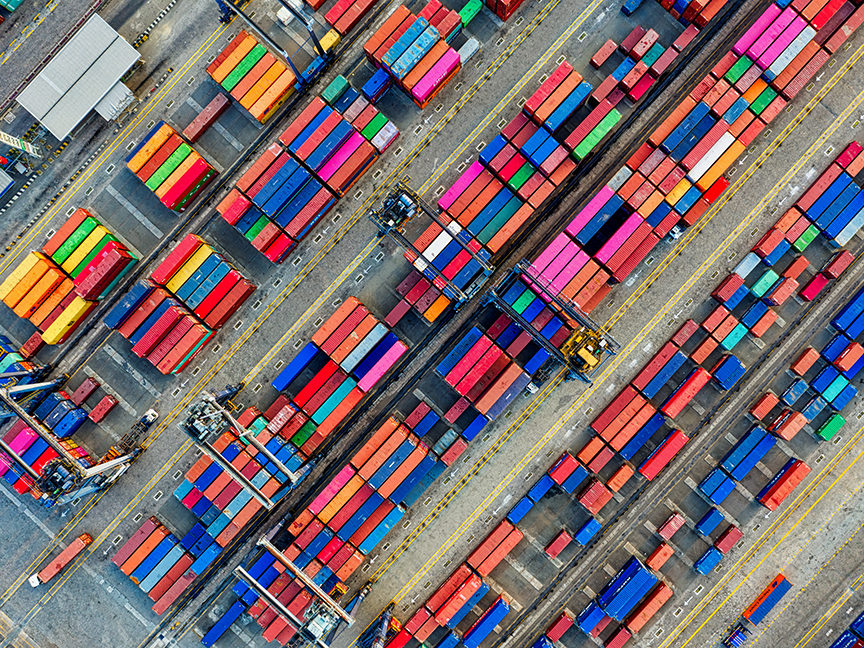

At the ports of Los Angeles and Long Beach — which together make the biggest gateway for ocean trade in the U.S. — 2021 saw record numbers of ships waiting for berths to offload their goods. The build-up of cargo contributed to goods shortages and price increases ahead of the holiday shopping season, and strained supply chains have put upward pressure on inflation.

Given this state of affairs, only better visibility, driven by data-informed decision making, can provide shippers with an edge. Companies need real-time, end-to-end multimodal visibility of their shipments and orders. Their subsequent decisions come in two main categories: short-term management and long-term network redesign.

Short-Term Management

Going into 2022, spot prices for container shipping are 10 times pre-pandemic levels at around $15,000 per 40-foot container, and the average value of goods in containers traveling from China to the U.S. is $50,000. What kinds of decisions can improve the ratio?

Data-driven changes become possible as businesses prioritize short-term optimization. They can make more dynamic decisions related to freight procurement, and allocate volumes on a discretionary basis across carriers, routes and lanes.

Long-Term Redesign

Shippers are faced with more difficult options in the long term. Calls for reshoring or nearshoring are increasing, but they rest on isolated examples. More likely, we’ll see changes in business strategy and messaging, with downstream effects on the supply chain.

For example, some companies have expanded brand-owned retail locations and direct e-commerce sales to improve margins. Others may do the opposite, taking on the challenge of emphasizing brick-and-mortar distribution to avoid competing with one- and two-day shippers amidst high fuel prices and driver shortages.

In terms of supply chain redesign, companies are examining the tradeoffs between suppliers, supplier location, transit times, routing and schedule reliability. In long-term redesign, the solution is to move from a challenging supplier or region, then make appropriate changes in lanes, services and carriers. Such actions won’t be easy, but could come with side benefits, such as shifting production away from countries with higher labor and production costs.

Given that supply chains will continue to be stressed, what companies can do now is deploy a real-time visibility platform to monitor in-transit shipments at the order level. By having end-to-end supply chain visibility, and advance information on lead-time changes, they can be proactive in making changes to production and distribution to minimize late deliveries.

While shipping capacity remains tight, business leaders must tread carefully. Every change — whether it’s new product materials, more customization, or new locations — can strain supply chains.

When any global system is disrupted, change is inevitable. This isn’t the year to wait and see if supply chains normalize (they’re unlikely to). This is the year to invest in data, and use it to realize both short-term management and long-term network redesign. Better information and decisions will differentiate brands in 2022, and determine which ones meet customer expectations.

Adam Compain is senior vice president of marketing and supply chain insights at project44.