Businesses were dealing with supply chain shortages long before the COVID-19 pandemic. Since 2020, however, the nature of those disruptions has changed, forcing companies to pivot more frequently and dramatically.

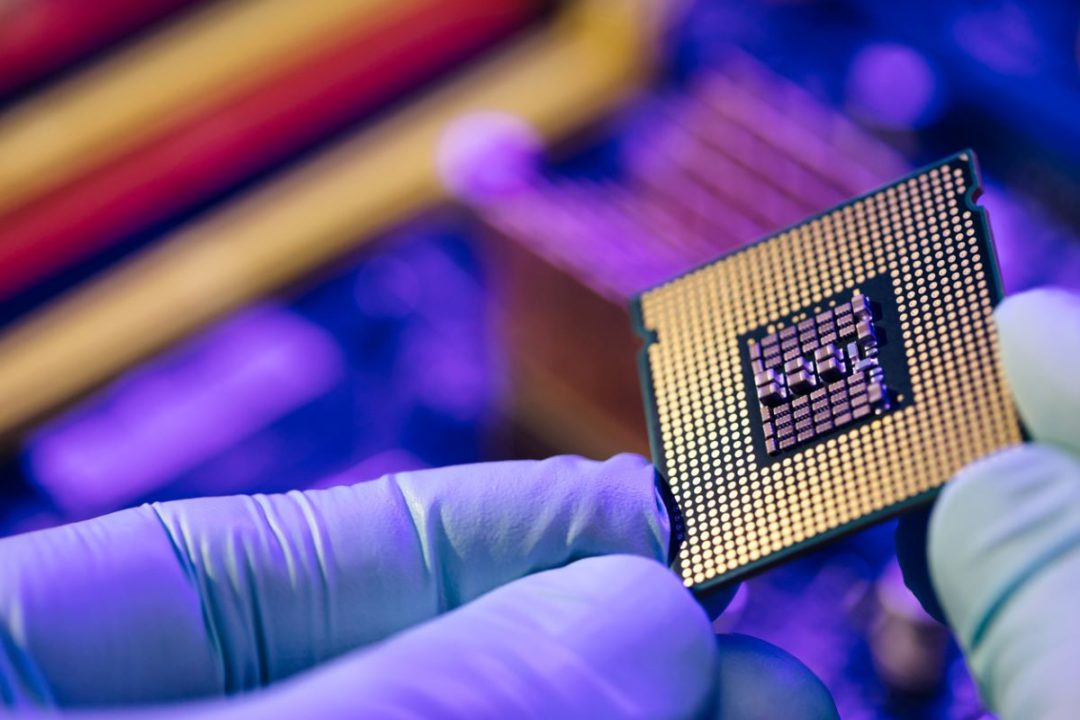

The semiconductor shortage in particular is forecasted to extend into late 2023 or early 2024. While some speculate that the market may be on its way to a natural recovery post-pandemic, others wonder how they’ll make ends meet over the next one to two years, until the market once again achieves a reliable and steady supply of product.

One major contributor to the shortage, the pandemic revealed, is a global overreliance on Taiwan Semiconductor Manufacturing Company (TSMC), whose foundries account for 65% of the global market. Now politicians and industry leaders are more seriously considering the overall landscape of the semiconductor market.

With the passage of the CHIPS Act, the U.S. has doubled down on its efforts to reduce its reliance on foreign suppliers. According to a congressional summary of the bill, currently 12% of chips are made in the U.S. While this could be considered a healthy first step toward the goal of North America becoming more competitive with foreign countries in semiconductor production, we’re still far away from the juggernaut that is Asia.

Ultimately, that’s a small step toward a more complex end goal. While the CHIPS Act is far from a silver bullet, it builds resilience in the supply chain and shifts some of the production back to the U.S., bolstering the economy and relieving some of the pressure caused by a heavy reliance on supplies from Asia. A steady supply of home-grown semiconductors will not only bolster the economy during construction and production but will also lay the groundwork for a faster, cheaper and more dependable stream of products.

It’s worth noting that the effects of this law may take years before they’re felt throughout the market. Not only do new facilities take time to build, but the typical roadblocks and regulatory processes that come with new projects will further slow the new influx of U.S.-made chips.

In the meantime, the need for new chips is still steadily growing, and companies are more concerned about a consistent stream of inventory than where the chips are made. This isn’t to say that the demand for U.S.-made semiconductors isn’t there, but that consistency in stock supersedes all else. More and more, companies are beginning to realize that because of this, new stock isn’t always a realistic or fiscally responsible solution to the issue.

Instead, faced with such uncontrollable outcomes, companies are increasingly asking reliable third-party maintenance (TPM) providers to step in with short-term support contracts and assist with coverage and procurement. These third parties acquire certified, tested and ready-to-go hardware, as well as source and procure IT components in the second-hand market. In this way, they can support customers by tapping into millions of assets globally. TPMs are equipped to weather supply storms and continue to offer an unsurpassed worldwide stock inventory even in a chip drought. By jumping straight in and providing stopgap coverage while organizations await ordered hardware, companies are able to reduce supply chain pressure and continue on unhindered.

Pre-owned and refurbished hardware not only provides cost savings but also makes procurement far easier due to sheer availability. Three- to nine-month delays in OEM hardware deliveries have become common due to persistent component shortages and supply chain struggles. In contrast, many of the most in-demand current and previous-generation networking equipment is available on the secondary market for immediate delivery.

You may venture into a TPM relationship as a short-term Band-Aid, but once you no longer have to manage an inventory of spare parts or deal with the hassle of sourcing new assets, you might be tempted to stay within the TPM’s umbrella coverage, even when the taps for chip supply open back up again.

There’s no black-and-white solution to the semiconductor shortage. Companies will continue to make tough decisions to remain successful and able to produce their products. However, cost-effective and easy-to-implement solutions do exist and are sometimes overlooked. It’s worth considering how important brand-new equipment truly is, and how utilizing available technology, equipment and stock might be the better, if not the only, choice to make.

Sachi Thompson is general manager, Global Hardware Division at Curvature.