When it comes to consumers’ expectations for home delivery, there are a lot of opinions and little concrete data.

Needless to say, the conversation typically devolves to “free and fast,” but that’s not what’s really happening for most retail markets — nor do all consumers think about delivery in the same way. A recent study by Descartes of 8,000 consumers in Europe and North America shows that consumers are open to options that can reduce costs while improving revenue, customer loyalty and sustainability. To reap the rewards, retailers need to stop treating home delivery monolithically.

Delivery personas involve a combination of cost, delivery speed, precision, value-added services and information about delivery options (such as the most environmentally friendly). When retailers craft a variety of delivery experiences, customers can self-select the one that best fits their delivery persona.

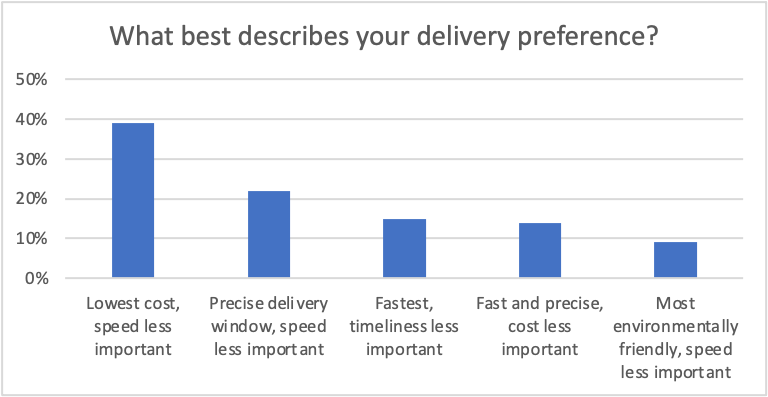

To get a sense of how they identified with different delivery personas, respondents to the Descartes study were given choices that had trade-offs reflecting real-world home-delivery capabilities. Lowest cost, speed less important was the highest-rated delivery preference (see Figure 1). Delivery speed, something mentioned frequently in the press as very important to consumers, was ranked considerably lower as the third preference and also as part of the fourth preference. Delivery precision scored higher than speed, which makes sense when compared later to how consumers rated current delivery performance.

Age also has a significant impact on delivery preference. For “lowest cost, speed is less important,” only 30% of younger consumers (18-34) identified with that persona, compared with 50% of older consumers (55+). Speed resonated with younger consumers, as the “fastest, timeliness less important” and “fast and precise, cost less important” personas received 11% and 7% higher scores, respectively, compared with older consumers.

Figure 1: Consumer delivery preferences

Source: Descartes/SAPIO Research

The type of product also impacts delivery preference. The lowest-cost delivery method was most important overall for purchases of books (44%) and films/music (43%), but less important for medicines (29%) and groceries (28%). Medicines (26%) and groceries (23%), however, received the highest scores for speed. White goods and furniture (tied at 26%) were the top product categories for delivery precision, followed by groceries and electronics (tied at 23%).

Across all respondents, 63% had concern for environmental impact when purchasing online and having the order delivered; however, there’s a wide degree in variability by age (see Figure 2) and geography (see Figure 3). Retailers selling products to younger generations need to consider sustainability as an important delivery persona.

Figure 2: Sustainability concerns by age group when purchasing with home delivery

Age Group | 18-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ |

2022 | 85% | 76% | 66% | 57% | 53% | 47% |

2023 | 84% | 76% | 69% | 58% | 50% | 49% |

Source: Descartes/SAPIO Research

Figure 3: Sustainability concerns by country when purchasing with home delivery

Country | France | Belgium | Germany | Nordics | United States | Canada | The Netherlands | United Kingdom |

2022 | 78% | 72% | 77% | 70% | 57% | 60% | 61% | 60% |

2023 | 76% | 72% | 71% | 66% | 62% | 54% | 49% | 49% |

Source: Descartes/SAPIO Research

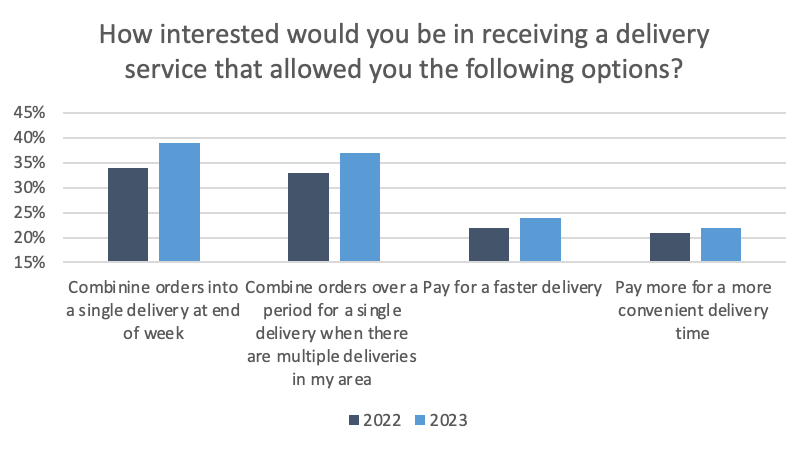

When it comes to delivery, consumers are more flexible than many retailers think, and are willing to take delivery options that can reduce costs, increase revenue and help the environment. The results of the 2023 survey show increased interest across the board (see Figure 4). The two combining options had the greatest consumer interest and a double benefit: They’re not only lower-cost but are also more environmentally friendly. For 2023, we included a new answer option to have the retailer highlight the most environmentally friendly delivery option, and it came in a close third (36%). These results are consistent with another Descartes study, which examined consumer sentiment of retailers’ sustainability practices around their delivery operations. In addition, the answers for faster and more convenient delivery times are consistent with what Descartes sees in its customer base. While the numbers may appear small, they’re actually significant because it doesn’t take a lot of customers to make a lot more money.

Figure 4: Delivery service options with highest (quite/very interested) level of interest

Source: Descartes/SAPIO Research

Corroborating research gives additional credence to the power of delivery personas. A study conducted at Erasmus University in The Netherlands examined how the presentation of eco-friendly delivery windows during the booking process had a significant impact on consumers’ delivery choices. The work was based on analyzing retailers that have employed delivery persona concepts, then creating simulations to test their hypothesis. The Dutch study said, “Our simulation findings suggest that green slots, compared to price incentives or no incentives, offer providers a way to effectively steer consumer time-slot choices to yield shorter routes, fewer delivery vehicles used, and more per-customer revenue.”

Delivery personas present retailers with a triple opportunity: to better align with consumer sentiment about home delivery, help protect margins, and protect the environment.

Chris Jones is executive vice president of industry and services with Descartes.