In a time of growing environmental awareness, retailers need to adjust their sustainability and home-delivery strategies, especially with respect to age.

Descartes commissioned a study of 8,000 consumers in Europe and North America to gain a better understanding of sustainability sentiment, and learn how consumers think about and act on their preferences. Here, we delve into the findings and explain how retailers can use them to increase revenue, customer loyalty and reduce delivery costs.

Consumers are increasingly concerned about the sustainability of the goods they buy and how they receive them. The study showed that 41% say they regularly or always make purchasing decisions based upon the product or company’s environmental impact. This concern is heightened by age and product category. Not surprisingly, younger buyers are much more concerned about sustainability when making purchasing decisions than older ones (see Figure 1).

Source: Descartes/SAPIO

To get a sense of the importance of environmental impact, we asked consumers if they would favor purchasing and picking up at a higher price, as opposed to buying online at a lower price for home delivery, if they thought it would help the environment. Product categories such as grocery and clothing and footwear topped the list of those eliciting the greatest environmental concern and action. Across all categories, however, there was a significant difference in what 18–34-year-old respondents would do versus 55+-year-old respondents and, to a great degree, with 35–54-year-old respondents (see Figure 2). Findings are also influenced by the point that younger consumers are less cost sensitive than older consumers according to our report Home Delivery for the Ages: The Demographic Opportunity.

Source: Descartes/SAPIO

The story about the impact of age on purchasing decisions, however, is not so simple. While previous answers point to younger consumers being more environmentally focused, if given a choice between convenience and the environment, they prefer convenience (see Figure 3) — and it’s the older consumers who lean toward the environmental delivery preference.

Source: Descartes/SAPIO

While younger consumers may value convenience more, this doesn’t necessarily mean faster deliveries. It could mean combining multiple orders into a single delivery or offering eco-friendly time windows options that are tighter, but that also increase delivery density. For younger consumers who believe in-store or locker-based pickup is more sustainable (54%), offering these services can reduce costs as the former leverages existing and more efficient distribution networks, and the latter consolidates many deliveries into a single location.

Older consumers are more cost-conscious and not interested in picking up online purchases. Offering them sustainable delivery options that are lower cost, such as slowing down the delivery or tying it to fixed days or eco-friendly time windows, allows retailers to optimize their home delivery costs and address sustainability concerns.

Home delivery is the dominant way that consumers get their online purchases (see Figure 4). This finding is consistent with convenience being the top reason for increasing home deliveries, as found in our study Dear Consumer: How Do You Feel About Home Delivery Now?. Younger consumers are much more willing to travel to get their online purchases than older consumers who would rather have them delivered.

Source: Descartes/SAPIO

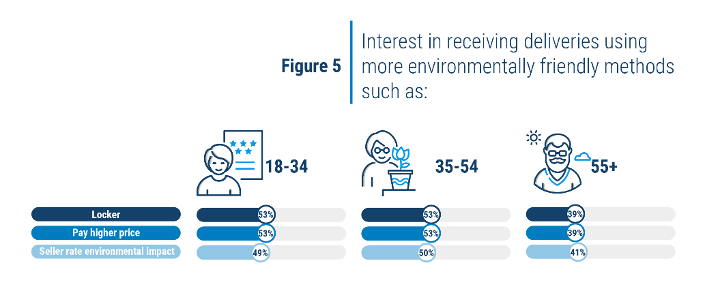

Overall, consumers of all ages are quite/very interested (60%) in sustainable delivery options, but there were three options where the specific sustainable delivery choice diverged by age (see Figure 5). Two of these choices (lockers and higher price) reinforce previous answers. Younger consumers were much more interested in knowing the environmental impact of all delivery options compared with the oldest respondents.

Source: Descartes/SAPIO

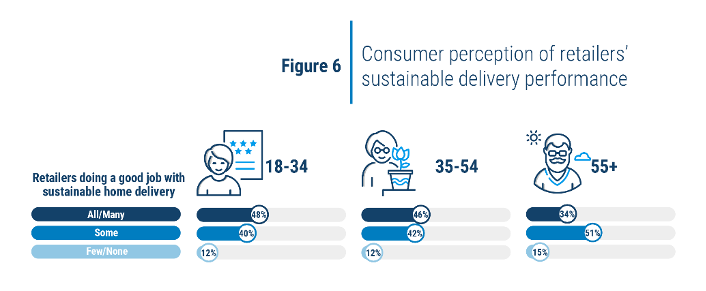

The next two figures show that younger consumers are more optimistic about retailer performance in home delivery sustainability, but more willing to act in the event of poor sustainable delivery practices, while older consumers are more skeptical about retailer performance but less willing to act.

Overall, there’s plenty of room for improvement in sustainable home delivery by retailers, but younger consumers believe that more retailers are doing a better job with sustainable delivery practices compared to older consumers (see Figure 6).

Source: Descartes/SAPIO

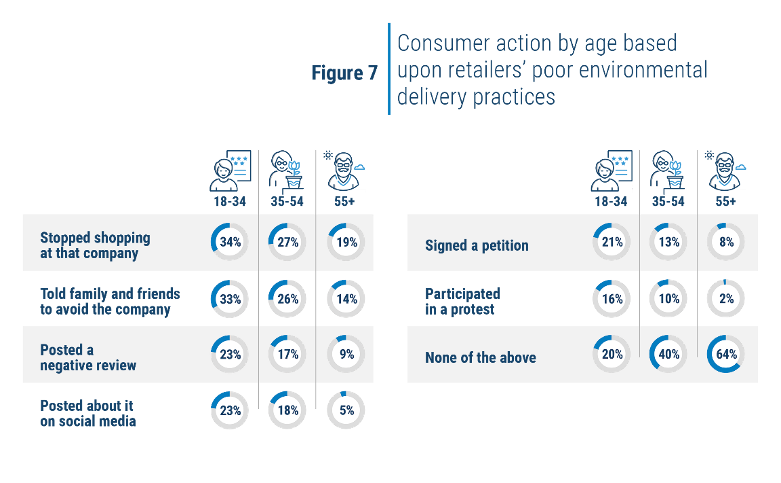

There’s a clear difference in willingness to act and severity of the action by age group. Overall, younger consumers (80%) are much more willing to act than are middle-aged (60%) and older (36%) consumers. This plays out in the specific actions that consumers are willing to take (see Figure 7).

Source: Descartes/SAPIO

Retailers, especially those selling to younger consumers, need to factor home delivery into their overall sustainability efforts because it’s increasingly being factored into purchasing decisions. Home delivery continues to be the dominant way that consumers receive their online purchases, and its convenience has gotten the attention of all consumers. Sustainable delivery presents an opportunity for retailers to improve the customer experience and reduce the cost of getting goods in customers’ hands.

Given how consumers perceive retailers’ sustainability efforts in home delivery and their willingness to act, sustainability should be perceived as a threat if ignored. For retailers, the key to making sustainability work is educating consumers on what the most environmentally friendly delivery options are, and letting them make their choice.

Another important consideration illustrated by Figure 2 is that, in many cases, home delivery is more sustainable than consumers picking up goods in stores or at lockers. Yet retailers haven’t done a good job at explaining this, especially to younger consumers. While there may be valid reasons, such as the cost to retailers of home delivery versus in-store pickup and concern for margin erosion, a large number of consumers will buy more from retailers that are perceived to do a better job at sustainable delivery. The risk that retailers run of not proving their case is that some competitors will understand this, associate their brand with sustainable home delivery, and end up with a greater share of the market. This is why it is so critical for retailers to understand which sustainable delivery options — and there are a number of them — also drive down home delivery costs to protect margins.

How consumers get their purchases is becoming an increasingly important part of the overall customer experience. By establishing and promoting sustainable delivery services as part of their overall fulfillment strategy, and considering demographics such as age, retailers can meet the unique delivery needs of their customers, help the environment and reduce costs.

Chris Jones is executive vice president of industry with Descartes.