As nearshoring gathers momentum, businesses have an opportunity to shorten their supply chains, with the goals of building resiliency, improving sustainability efforts and alleviating challenges with current suppliers.

Capterra’s Supplier Relationships Survey reveals that 88% of small and medium-sized businesses are planning or actively engaged in North American nearshoring initiatives. (The study doesn’t isolate for U.S.-based suppliers — those in the U.S., Mexico and Canada are combined in the findings.) The top benefits SMBs expect to see by nearshoring are quicker delivery and fulfillment, improved communication and increased sustainability.

In interpreting these findings, it’s important to understand the difference between nearshoring (American manufacturers switching to suppliers in Canada and Mexico) versus reshoring (moving to suppliers in the U.S.).

Nearshoring may appear straightforward at first glance, but for U.S. SMBs, there are many challenges and considerations that make the transition more complex. From the regulatory and legal considerations to managing the transition effectively, SMBs need to have realistic expectations as to how quickly it can be accomplished.

According to Capterra’s research, SMBs have an average of 27 key suppliers, many of which don’t yet have clear replacements in North America. The good news is that switching suppliers will become easier in the coming years, as the U.S. government and manufacturers prioritize reshoring or nearshoring initiatives.

Following are three tips to help SMBs with their nearshoring strategies.

Choose the right suppliers. SMBs report that the most challenging aspect of managing suppliers is strategically choosing between new ones —yet that decision is crucial for a successful nearshoring strategy. When evaluating potential suppliers, SMBs need to consider pricing, quality standards and sustainability practices, which are the top three factors SMBs say they value most.

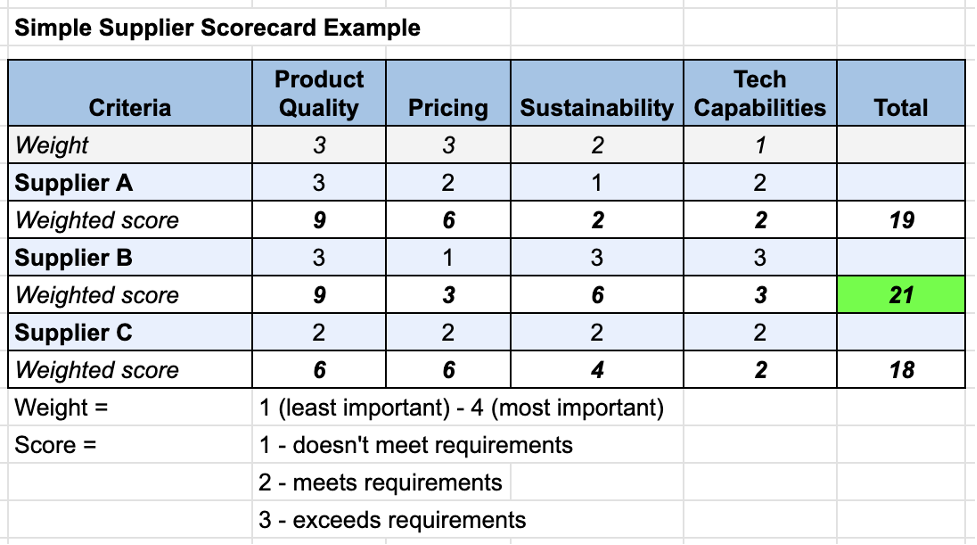

Create a scorecard to help you evaluate and compare different suppliers in a methodical and consistent manner. This can be a helpful exercise for your team to complete together, as it helps articulate requirements and expectations that will form the criteria on the scorecard.

Teams should assign different weights to each criterion based on their specific needs and concerns. For example, Capterra’s research shows that product quality is the most important factor that SMBs consider when picking a new supplier. Therefore, this criterion should be weighted more heavily than he supplier’s risk-management plans —which ranked toward the bottom of the surveyed SMBs’ priority list.

Here’s a simplified example of a weighted supplier scorecard:

(Source: Capterra)

Check if one of your current software tools has a supplier or vendor scorecard function; if not, you can create one using any spreadsheet software. By strategically choosing new suppliers based on key requirements and using a supplier scorecard to compare them, SMBs can feel confident in their selection of new partners as they implement their nearshoring strategy.

Improve your sustainability strategy. Switching to new suppliers presents an excellent opportunity for SMBs to enhance sustainability strategies. Capterra’s past Supply Chain Management Trends Survey finds that 80% of SMB supply chains plan to increase or continue to invest in sustainability efforts over the next several years.

Here are some ways you can improve these efforts by working with environmentally conscious suppliers:

- Evaluate their sustainability practices. This includes energy consumption, waste management, ethical labor standards and fair trade practices. Ask about their company guidelines and certifications to verify compliance with responsible sourcing policies.

- Look for sustainable packaging and product design. Ask about suppliers’ use of eco-friendly materials, how they reduce excess packaging, and ways they promote recyclability or compostability. Those that prioritize sustainable packaging and product design can significantly contribute to the overall sustainability efforts of your business.

- Review circular economy practices. Inquire if suppliers adopt practices such as product life extension, repairability, and recycling or repurposing initiatives. By choosing suppliers that use a closed-loop approach, where materials and resources are reused or recycled, SMBs can help minimize waste and contribute to a more sustainable ecosystem.

Enhance your digital transformation. Switching to new suppliers as a part of your nearshoring strategy also presents an opportunity to enhance your digitization efforts. Here are some ways in which you can increase your digitization during this transition:

- Verify software system compatibility. Evaluate the supplier’s use of supply chain management software and its integration capabilities. Having compatible software or integrating with their software can streamline processes, reduce paperwork and provide visibility into inventory, orders and logistics.

- Ask about their use of advanced technologies. Understand the supplier’s level of embracing technologies, including internet of things (IoT)-enabled tracking tools such as sensors, radio frequency identification tags or GPS trackers, automated picking and packing systems, and use of robotic process automation. Such technologies can lead to cost savings, increased productivity and improved accuracy.

By investing in technology and digital systems, SMBs can not only strengthen their processes, but can also better collaborate and problem-solve with suppliers that are also embracing advanced technologies.

Nearshoring presents a promising avenue for SMBs to improve their supply chain operations. By following these recommendations, they can transition to North American suppliers while capitalizing on the advantages of quicker delivery and fulfillment, enhanced communication, and improved sustainability practices. As the nearshoring trend continues to grow, proactive SMBs can position themselves for long-term success in an increasingly dynamic global trade environment.

Olivia Montgomery is an associate principal analyst at Capterra, a software and services marketplace.