When Iranian-backed Houthi militants in Yemen stepped up their missile and drone attacks on commercial shipping in the Red Sea and Gulf of Aden in early 2024, scare stories touted supply chain disruptions and renewed inflationary pressures just when it seemed that economic headwinds might be turning into tailwinds.

However, a succession of disruptive events in recent years – from COVID-19 lockdowns to the blockage of the Suez Canal in 2021 and Russia’s war in Ukraine – have honed supply chain organizations’ crisis management skills and caused them to build up their resilience muscles. So when container and cargo ships were attacked, and the United States and its allies countered with military strikes against Houthi targets, supply chains took the re-routing of vessels, longer lead times and additional fuel costs in their stride.

Responding quickly to the latest disruption is vital. But supply chain resilience is about more than reducing risks and minimizing negative impacts in challenging circumstances (see graphic below). It should enable companies to seize new opportunities, boost competitive advantage and delight customers. Moving from risk-reduction mode (defense) to opportunity-creation mode (offense) is the next play for supply chain leaders. To succeed in this transition, they must demonstrate to C-suite colleagues that resilient supply chains are worth investing in, even when this incurs additional costs.

Balancing Resilience and Cost

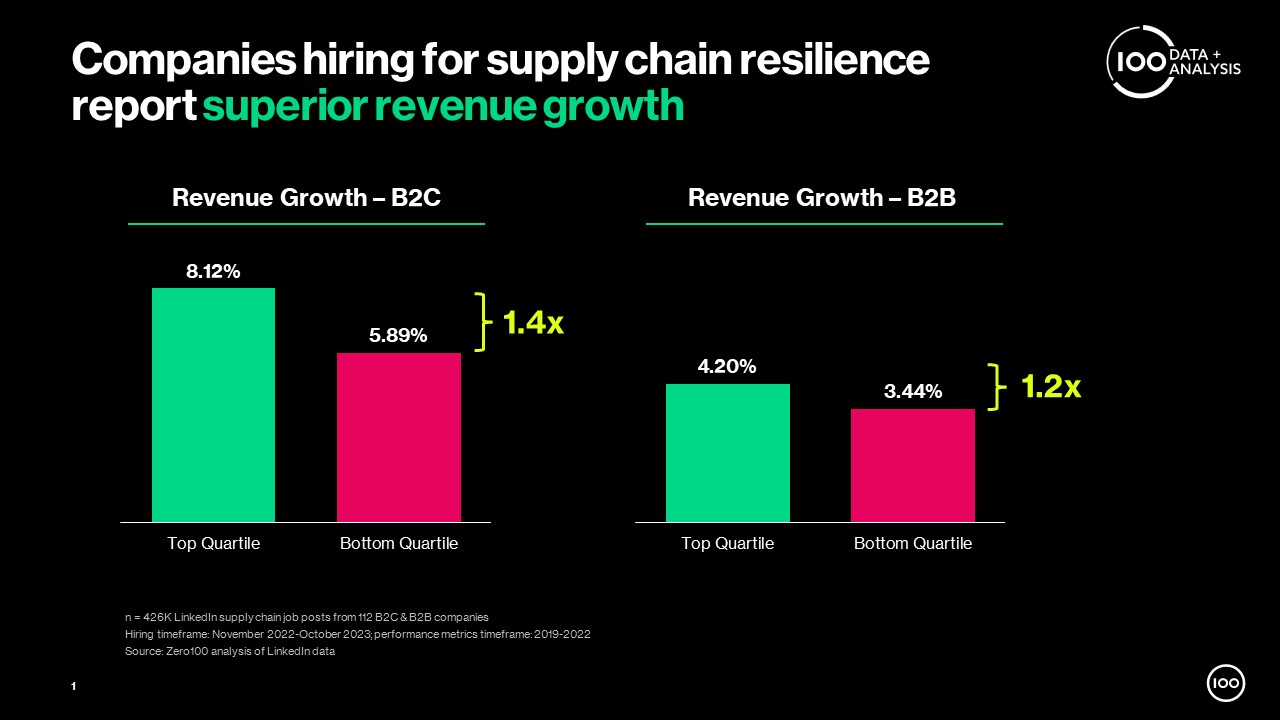

Companies that invest in supply resilient supply chains see greater agility to respond to demand changes, improved service and customer satisfaction levels, greater market share and superior revenue growth. An analysis conducted of more than 425,000 supply chain job descriptions posted by more than 110 companies found that average revenue growth among the top quartile (those most actively recruiting for resilience) was 1.4x those in the bottom quartile in the case of business-to-consumer brands and 1.2x in the case of business-to-business firms (see chart).

An analysis of the most recent earnings calls by 145 large companies showed that 26% mentioned supply chain resilience issues to a significant degree. They include major brands in consumer products, including Procter & Gamble, Nestlé and Ralph Lauren; retail, including Walmart, Amazon and Best Buy; and automotive, including Volvo, Renault and Stellantis.

Yet, twice as many CEOs on these earnings calls focused on cost management. This underlines the fact that, despite a lot of pandemic-inspired talk about inventory-laden “just-in-case” supply chains being the future, the truth is that resilience is not a substitute for cost-efficiency. There is a trade-off. Decisions need to be weighed carefully to ensure that resilience is not unthinkingly sacrificed at the altar of cost optimization.

A sourcing decision to consolidate the supply of a critical raw material to gain a 3% price cut on a $100 million contract, for instance, might be ill-advised if $5 billion of product revenue was then dependent on a single supplier — generating a single point of potential failure in the supply chain.

Resilience Strategies and Capabilities

Resilience starts with the design and development of new products, ensuring not only that unnecessary costs are eliminated early in the cycle, but also that pertinent risk factors (e.g., hard-to-source or nearing-end-of-life components) are fully evaluated. Resilience is also the responsibility of all supply chain functions — plan, source, make, move — whose trade-off decisions take place across multiple time horizons.

For example, long-term decisions include choices around network design and supplier selection by the sourcing and manufacturing functions.

On the other hand, medium-term decisions include efforts to achieve supply-demand balance by the supply planning and demand and inventory planning functions.

Further, short-term decisions include allocation trade-offs, choices between sea versus air freight, or last mile-inventory deployment by the logistics function.

Resilience should be built into supply chain operating models, network optimization plans and regenerative (circular) strategies for sustainability. It’s a foundational requirement, not a “nice to have” to be bolted on later. But few, if any, companies have the resources necessary to make all parts of their supply chains resilient. So choices have to be made about when and where to target investments that make specific nodes less fragile and more robust.

Against a backdrop of rising geopolitical tensions, a central focus for many large companies is diversifying, de-globalizing and regionalizing their supply chains away from an over-dependence on China. In some cases, this means shifting manufacturing operations to other cost-competitive countries in Asia, such as Vietnam and India. In others, it’s about nearshoring production closer to customers in the U.S. and Europe, using plants in countries such as Mexico and Hungary.

To improve resilience, regionalization needs to include the development of a local supply base. As it moved its smartphone manufacturing plants out of China to Vietnam during the past decade, for example, Samsung steadily grew its local sourcing, and now receives components from around 30 supplier production sites within the country. Securing the co-operation and active participation of key suppliers is essential to this strategy, as it is with others designed to boost resilience. There is only so much one company can do when it is dependent upon a multi-tiered ecosystem of supply partners. Trust-based collaboration is also needed internally between supply chain and functions such as enterprise risk, information security and sustainability. On both fronts, there is plenty of scope for improvement.

From a capability perspective, most organizations, up to this point, have focused on improving their ability to identify, assess and mitigate supply chain risks, and on responding quickly to disruptive events. Crisis management is a vital capability, but reacting to risk issues and putting out fires (literally in the case of Red Sea shipping) is only one dimension of supply chain resilience. Leaders must also take a proactive, intentional and strategic approach that seeks to get ahead of operational disruptions and, in the process, create a platform for growth.

AI-Powered Resilience and Digital Talent

Given the complexity of modern supply chains, and the wide array of risk factors that can disrupt them, it is impractical for large companies to rely on spreadsheets and largely manual efforts — as many still do today. Resilience requires the harnessing of data and AI/digital technologies in three broad areas.

Visibility includes supplier network mapping at multiple tiers, using knowledge-graph technology; real-time inventory in-transit using logistics and planning control towers; and hourly monitoring of risk issues across a global footprint — from earthquakes to M&A activity — using web scraping of thousands of local, national and industry news sources.

Analytics includes mining unstructured data for risk intelligence (e.g., on social media platforms) using AI and machine learning algorithms; automated supplier risk profiles derived from specialist datasets (including financial risk, cybersecurity risk and geopolitical risk); and predictive risk models based on historical performance (e.g., delivery, quality) using AI/ML capabilities.

Simulation includes the use of scenario-planning and modelling tools to understand how a disruption in one part of the supply chain might impact others, and to evaluate potential mitigating actions. You should also consider using digital twins to simulate the resilience of, say, product designs, and manufacturing plant configurations.

It follows that resilience requires talented strategists with the digital skills required to use data and AI-powered tools in order to proactively pinpoint high-risk vulnerabilities, mitigate risks and get ahead of disruptions — and competitors. Alongside digital skills, these staff need softer skills, including communication, creativity, problem-solving and change management, to influence key stakeholders and shift the organizational mindset from defense to offense. Supply chain teams also need “athletes” who can execute the resilience playbook in times of trouble, and who have the stamina to cope with a continual wave of sometimes simultaneous risk events.

Geraint John is VP of Research at Zero100.