Visit Our Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Park Jin-ok was one of the first to take voluntary retirement at Hyundai Heavy Industries Co. after working as a welder for the world’s largest shipbuilder for 15 years. Since he left in 2016, he has been joined by some 35,000 workers who quit or lost their jobs at the shipyard in South Korea’s port of Ulsan, in a downturn as dramatic as it was sudden.

Before then, Ulsan was the richest city in the country for nine straight years by income per capita. The decline that followed tells the story not only of the seismic forces shaking the global shipbuilding industry, but also a schism that’s dividing South Korea over its vast, family-run conglomerates — the chaebol — which lifted South Korea into the pantheon of leading industrial nations.

“There was a lot of pressure, especially for those who had only a few years left until retirement and received high salaries,” Park, 46, said in an interview in Ulsan on the southeast coast.

Ulsan is known as Hyundai Town, an industrial powerhouse with the world’s largest car-assembly plant, its third-biggest oil refinery and the giant shipyards. The 4 kilometers of docks were begun by Hyundai Group founder Chung Ju-yung in the 1970s, sounding the death knell for rival yards across Europe and the U.S.

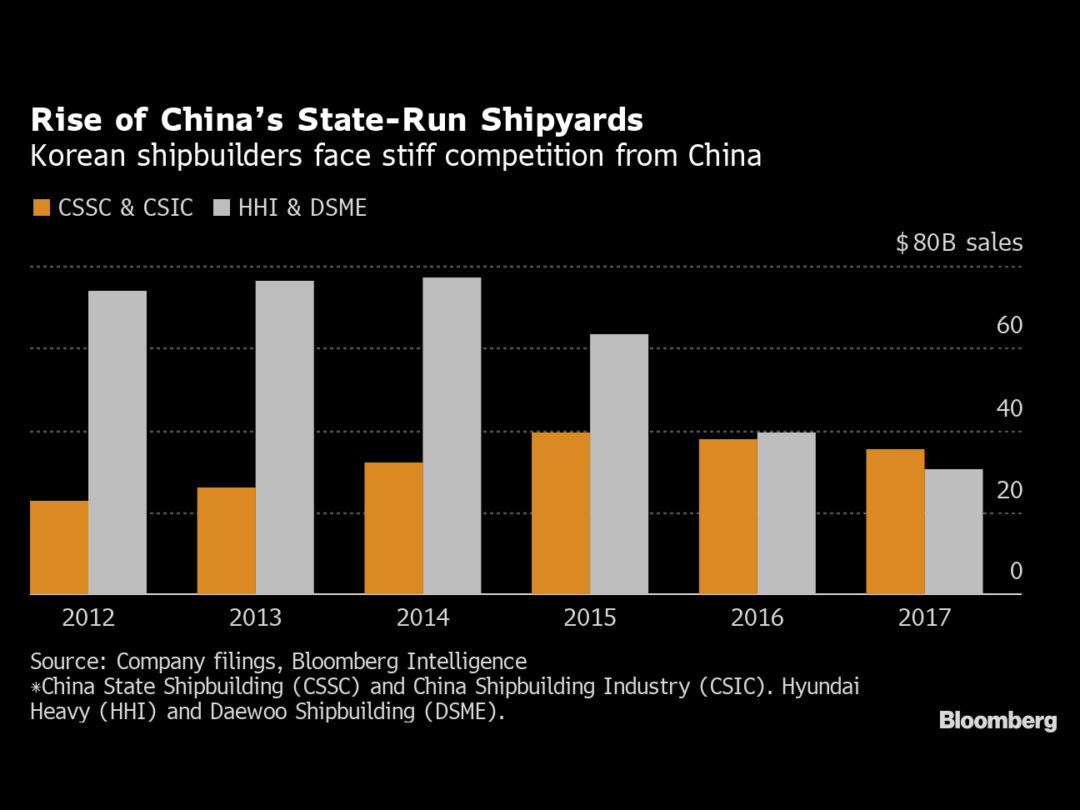

Now, South Korea faces the same threat from China. By 2021, China’s market share will reach 52%, up from 24% in 2008, according to Bloomberg Intelligence. In the same period, South Korea’s is expected to fall to 22% from 38%. China plans to merge its biggest state-run shipmakers, China Shipbuilding Industry Corp. and China State Shipbuilding Corp., to create a behemoth that would overtake Hyundai.

At the same time, South Korea’s chaebols are facing their own structural threat as more Koreans question the benefits of the nation’s industrial model now that growth in many industries is slowing. That’s making it more complicated for families like the Chungs to hand over power to the next generation.

To counter the increasing competition in the market, Hyundai Heavy agreed in March to tie up with local rival Daewoo Shipbuilding & Marine Engineering Co., merging the world’s two biggest shipbuilders under a new, Seoul-based holding company called Korea Shipbuilding & Offshore Engineering Co. through a share swap with major shareholder Korea Development Bank.

The merger, which still needs approval from local and foreign antitrust regulators, would reduce domestic competition and slow Chinese shipbuilders’ market share gains, according to Bloomberg Intelligence.

In Ulsan, the move sparked a wave of protests, fueled by fear that moving the new holding company to Seoul would leave behind the operating company, Hyundai Heavy, saddled with debt. In May, Mayor Song Cheol-ho shaved his head in a public protest.

Hyundai “will take out research and development personnel and profits,” said Kim Yearn-min, an industrial engineering professor at the University of Ulsan. “There’s a high possibility that the city would turn into a rust belt.”

The restructuring allocated 95% of liabilities to Hyundai Heavy, raising its debt-to-equity ratio to 131%, according to filings. KSOE, on the other hand, has 3.7% debt-to-equity and takes all of the retained earnings. And employees are worried the merger would lead to more job cuts, especially among contractors.

“It could make it harder for workers when negotiating wages,” said Park Sangin, a professor at Seoul National University’s Graduate School of Public Administration. “The split gives advantages to shareholders while giving disadvantages to workers.”

Hyundai Heavy said acquiring Daewoo Shipbuilding outright would have cost at least 6tr won ($5bn) and it was more efficient to set up KSOE as a holding company through the share-swap, with the two operating companies retaining independent management. It said Hyundai Heavy’s debt is still less than half the level during the boom years.

The company said it didn’t force anyone to take early retirement and workers’ jobs are secure as business has picked up. Last year, Hyundai Heavy met its target by booking orders for 163 new ships, worth about $14bn, up from $9.9bn in 2017.

“There will be no labor reduction and labor security will be ensured,” the company said in an email. “We lag behind China in terms of price competitiveness. We believe there will be a lot more synergy when the two companies’ R&D capabilities are combined.”

But workers are concerned the new structure has another effect, one tied to the way the nation’s big industrial families keep control of their wealth and, some politicians argue, the lives of millions of Koreans.

Hyundai Heavy’s biggest shareholder is 67-year-old Chung Mong-joon, the Hyundai Group founder’s sixth son. Chung’s own son is now being groomed for a top role in the shipbuilding business. Their combined stakes in Hyundai Heavy are worth $1.3bn.

“Chung’s family needs to prepare for tax payments in terms of succession planning,” Park said.

Korean chaebols are typically a morass of cross-holdings that tie the companies into an industrial ecosystem controlled by family members. To pass the mantle from one generation to the next, children need to buy or inherit stakes in parts of the group. With inheritance taxes as high as 65%, the bulk of that transfer needs to be done during a parent’s lifetime.

After Chung’s father’s death in 2001, the Hyundai Group was broken up, with the second son, Chung Mong-koo, taking control of the auto business, which owns the car assembly plant in Ulsan. He has a net worth of $4.4bn, making him South Korea’s fourth-richest person, according to the Bloomberg Billionaires Index.

On the shipbuilding side, Chung Mong-joon’s control was strengthened in 2017 with the establishment of an overall holding company, Hyundai Heavy Industries Holdings Co., in which Chung has a 25.8% stake. Chung doesn’t have an official management role, but his eldest son, Ki-sun, 37, runs one of the units and heads the group’s planning office.

Ki-sun bought a 5.1% stake in HHI Holdings last year for 354bn won, money that was largely given to him by his father. That cash is subject to a gift tax that can be as high as 50%.

One way the family earns money is through dividends. In 2018, HHI Holdings distributed a 270.5bn won cash payout, even after net income fell 72%, according to the company’s annual report.

The company said that it’s run by professional management and the Chung family wasn’t involved in the decision to split the business. It said Chung wasn’t available for an interview.

Even so, the move to reorganize fueled anger and dismay in Ulsan, where Chung was once a beloved politician who represented the eastern district around the docks for 20 years from 1988. He also served as vice president of global soccer body FIFA from 1994 to 2011, though his campaign for the FIFA presidency was derailed after as he was sanctioned for ethical violations related to South Korea’s 2022 World Cup bid. Chung has denied wrongdoing.

Filled with banners decrying the company’s split and demanding reform of the chaebols, Ulsan’s eastern district was designated an industrial crisis zone last year, a status that has been extended for an additional two years.

“They only care about benefiting the holding company and other businesses that help the Chung family,” said Kim Do-hyup, who used to supply labor to Hyundai Heavy before his company went bankrupt. He said Hyundai Heavy kept cutting fees as the downturn deepened.

With his debts rising, Kim went to a local temple to commit suicide by drinking pesticide and soju. He said a friend tipped off the police, who stopped him. Now, he has a part-time job, but still spends some of his days protesting in a tent pitched outside the dockyard along with other subcontractors who told similar stories.

“We are at the bottom and our lives hang on Hyundai, but they don’t care,” he said.

The company said subcontractor payments are based on work plan and cost and were frozen in 2016 and 2017 because of the downturn. “As the order shortage has continued, we’ve seen more conflicts with subcontractors. We believe this will be resolved through efforts to recover the shipbuilding industry’s competitiveness,” the company said in the email.

But in the streets around the docks, the feeling of despair is palpable. Cafes and restaurants near the shipyard were empty during a recent weekday lunch hour. It was the same in the evening. Shim Jae-ik, who has run the Nice Octopus restaurant for almost 30 years, said his place used to be packed with workers having team dinners or other gatherings. He said the pickup in orders had briefly given hope that things would improve, but the announcements of the split and merger with Daewoo quashed that.

“After the news, business is even more depressed,” Shim said. “Now, we have no hope.”

RELATED CONTENT

RELATED VIDEOS

Timely, incisive articles delivered directly to your inbox.