Visit Our Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBay Inc. has been a resilient internet pioneer and also a confounding one. Now a new leader will have to solve the riddle.

The company announced on Wednesday that Devin Wenig, the chief executive officer since 2015, had stepped down. The company’s chief financial officer, a longtime EBay employee, was named interim CEO while the company hunts for a permanent successor. Ebay shares dipped nearly 2% on the news.

EBay is an oddball of the internet economy. It’s both a success with more than $90 billion in merchandise and event tickets sold each year, and it has vast unfilled potential. In the U.S., EBay’s market share of online shopping is second only to Amazon.com Inc., although it is a distant No. 2. Its classified websites are popular in several countries, and the company generates most of its revenue outside its home country.

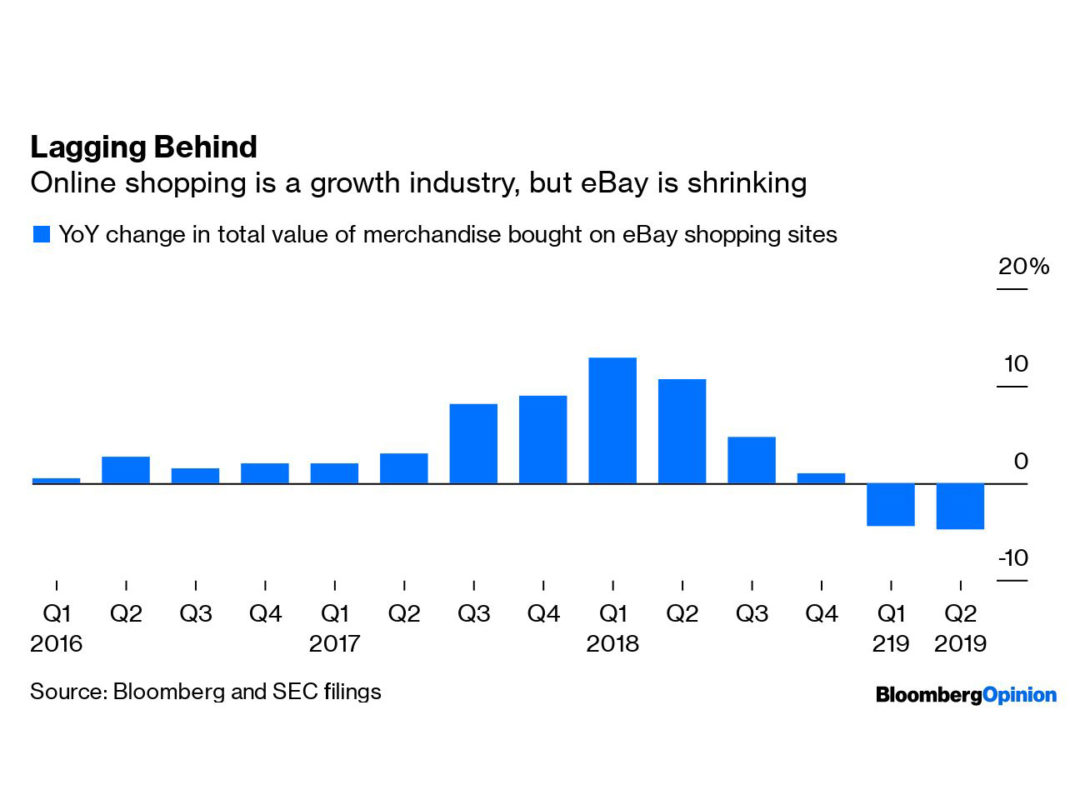

But while online retailing is a naturally growing sector as people shop more from their sofas and smartphones, EBay has stopped growing. The dollar value of transactions on its main shopping businesses started to shrink this year.

EBay’s central problem won’t be easy to solve by a new CEO. People who shop on EBay tend to love it, but a swath of online shoppers never think about EBay at all. This conundrum has vexed several administrations of EBay leaders. And across the industry, changing consumer habits are turning retail shopping upside down, and EBay hasn’t successfully capitalized on emerging niches or trends. Online shopping insurgents such as Etsy Inc. in handmade goods, Goat in sneakers and streetwear and the RealReal Inc. in consignment, have encroached on what should be EBay’s natural turf.

That was a big reason Elliott Management Corp., the activist investor, went public with its criticisms about the company early this year, landed seats on the board and urged a review of the company’s structure and operations. On Wednesday, EBay said those reviews are continuing.

EBay has made deliberate and pragmatic choices not to chase hot e-commerce trends or low-margin areas such as groceries and instead focus on its strengths: its loyal customers, global reach and a business model with better economics and less risk than many online retailers. The approach is sensible, but EBay has been missing opportunities as online shopping reshapes the $20 trillion in annual global retail spending. Investors had lost faith in the company’s approach.

It’s not clear a new CEO will have fresh solutions to what EBay should be. It seems more likely now that EBay will ditch some of its assets, including its StubHub event ticket business and its network of classifieds websites. The fees for merchants that sell on EBay are also low compared with those charged by Amazon and other competitors, and that may be an area where EBay can dial up revenue growth — although it risks turning off merchants the company needs to thrive.

Wenig tweeted on Wednesday that it became clear he wasn’t “on the same page as my new board.” That would be the board including two people added at Elliott’s request. It will be interesting to see whether the investment firm will see EBay through only long enough for a potential transaction to jettison StubHub or other assets.

EBay is a test of whether Elliott can help steer a tricky operational challenge, not just nag for a stock-boosting rearrangement of deck chairs. No matter what, EBay’s decision to change CEOs shows that the company’s sensible approach to e-commerce isn’t working, and it’s time to take greater risks to capitalize on changing shopping habits.

RELATED CONTENT

RELATED VIDEOS

Timely, incisive articles delivered directly to your inbox.