Visit Our Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The U.S. chip industry said as much as $50 billion in federal incentives will be needed to halt a decades-long trend of manufacturing moving overseas as China spends heavily to become a leading semiconductor producer.

The federal government needs to deploy $20 billion to $50 billion to make the U.S. as attractive a location for plants as Taiwan, China, South Korea, Singapore, Israel and parts of Europe, the Semiconductor Industry Association said in a study released Wednesday. Failure to do that threatens U.S. leadership of the sector as a whole, it added.

The lobbying group, which represents companies such as Intel Corp. and Qualcomm Inc., is making the pitch at a time when it believes Washington is more open to listening. The China-U.S. trade war and supply-chain disruptions caused by the pandemic have revealed the risks of having such vital components made abroad.

“Six months ago, I don’t think we could have had this discussion, the world’s gone in our direction,” said John Neuffer, chief executive officer of the SIA. “It’s not a bit of a change in Washington, it’s a significant shift.”

The $400 billion semiconductor industry is led by U.S. companies, but many chipmakers, such as Nvidia Corp. and Qualcomm, outsource production to factories mostly in Asia. Taiwan Semiconductor Manufacturing Co. dominates that part of the market and also makes chips designed by Apple Inc. and other U.S. tech giants.

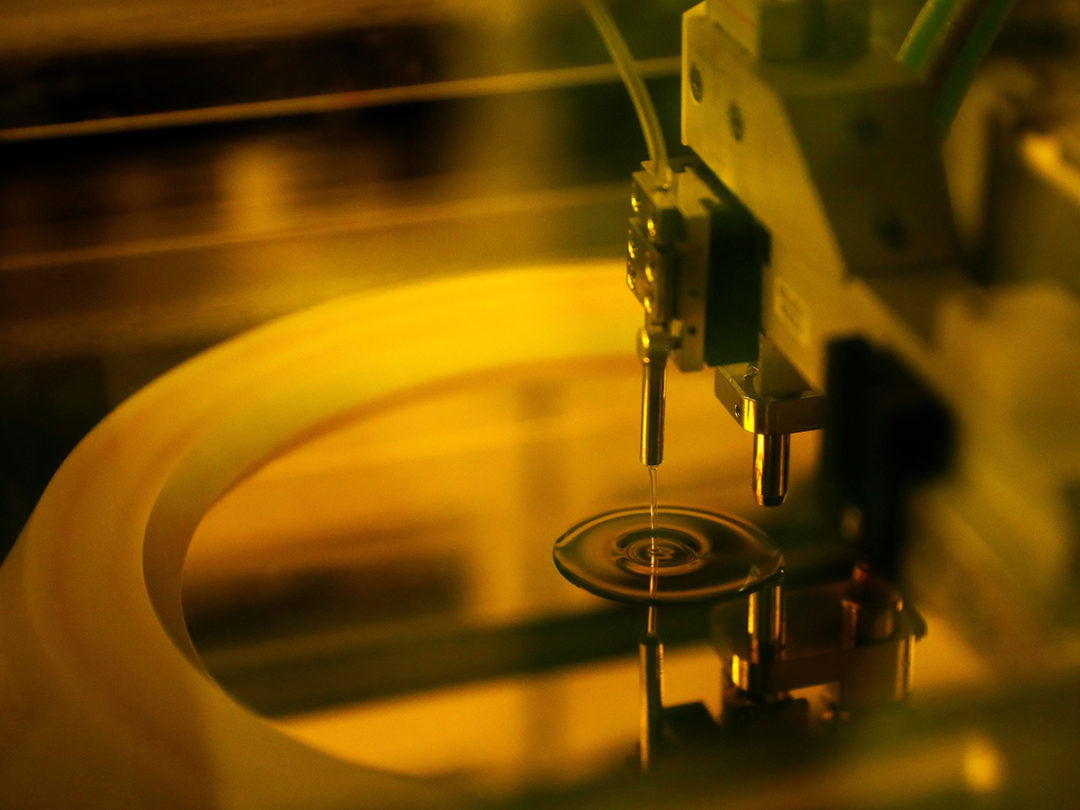

Production techniques, including chemical processes, and complex manufacturing equipment play a vital role in determining chip performance. The U.S. needs to keep a chunk of this work domestic so it can maintain its knowledge base and ownership of the skills, the SIA said.

While U.S. production ebbs, China’s government is pouring money into its domestic semiconductor industry, conferring the same kind of priority on the effort it accorded to building its atomic capability. That has made chip manufacturing a matter of national security.

The SIA said new U.S. plants built with federal support “would bring state-of-the-art manufacturing technology and sufficient capacity to cover semiconductor demand from the U.S. defense and aerospace industries.”

Only 6% of the new global capacity in development will be located in the U.S. In contrast, China will add about 40% of the new capacity over the next decade and become the largest semiconductor manufacturing location in the world, the SIA noted in its report.

Senator John Cornyn is sponsoring a bipartisan CHIPS for America Act to increase government support for the industry, and he weighed in on the issue on Wednesday.

“Domestic semiconductor manufacturing has been steadily declining, and the COVID-19 pandemic has made clear how vulnerable our existing supply chains are,” the Republican senator from Texas said. “This report underscores the need to boost American production of semiconductors.”

Locating a plant in the U.S. costs about 30% more over a decade than comparable sites in Taiwan, South Korea and Singapore. China may be as much as 50% cheaper, according to the report.

It takes as much as $20 billion to build a big chip plant, considerably more than a new aircraft carrier or nuclear power plant, the report estimated. Over a decade, semiconductor factories cost as much as $40 billion. Government incentives around the world reduce that bill by up to $13 billion, according to the report.

Most incentives in the U.S. are provided by state governments that can’t compete against countries with bigger budgets, the SIA said. Some countries offer grants to make the required land free. Others slash corporate and property taxes or help with the cost of equipment purchases. The U.S. ranks way down the list in most of those categories, many controlled by Washington, the group added.

RELATED CONTENT

RELATED VIDEOS

Timely, incisive articles delivered directly to your inbox.