Near-empty shelves in supermarkets have become symbolic of COVID-19’s impact on the supply chain.

As we come to terms with the pandemic, and panic-buying abates, stocks are coming back into the stores for most durable goods. Unfortunately, it isn’t the same for every industry. For automakers that braved a comeback after two months of shutdown, newly diagnosed coronavirus cases among workers within two days of opening revealed a shaky path to sustaining production at full capacity. Similarly, manufacturers of durable goods, chemical products, and electronic goods are looking at idling production to limit their losses.

At first, it was the supply side that dipped, with lockdowns and restricted international deliveries. But as the virus continued to play havoc with operations, there has been a rise in unemployment, with 39 million Americans losing their jobs in nine weeks, and a drop in international trade causing a dip on the demand side.

Falling demand and supply aren’t the only variables that American industries are struggling with. U.S. manufacturers that moved production to China and other Asian nations, riding on low labor costs and regulatory factors, found themselves impacted disproportionately as their foreign suppliers went under lockdown.

Traditionally, organizations have always focused on lowering costs, inventories and optimizing asset utilization when building their supply chains. This linear model means they don’t have the flexibility to recalibrate their supply chains when disruptions such as COVID-19 occur.

Not every industry is struggling in these pandemic times. Non-durables such as food and household products, medical equipment, pharmaceuticals, and hygiene products are witnessing a sustained spike in demand.

The increase for these commodities is expected to drive the logistics market as consumers continue to make online purchases. We need people who will pack the goods we order, and manage distribution once products roll out of factories. We need drivers who will deliver the products to cities and homes.

As one market researcher predicts, the global logistics market will grow from $2.7 billion in 2020 to $3.2 billion by 2021. The report identifies the major drivers of this market as an increased focus on the continued supply of essential commodities, creation of a supply-chain stabilization task force to fight COVID-19, and growing demand for personal protective equipment.

The logistics industry must prepare for this trend, and devise strategies that will meet short-term demand. It needs to study changing patterns in global trade, and be ready for potential shifts in channels.

Strategic decisions and actions that supply chains and logistics providers should consider include:

- Engaging in greater collaboration. Logistics providers are likely to collaborate with related companies to step up their capabilities and cater to the rising demand for supplies. For example, UPS Healthcare has joined with Resilinc, a provider of AI-based supply-chain mapping, to locate and deliver critical medical items and equipment. FedEx is collaborating with governments, NGOs, suppliers and retailers to deliver COVID-19 test kits and protective equipment. Bergen Logistics is providing warehouse space to a mobile field hospital.

- De-risking through supply-chain strategies. Supply chains are likely to become much more diversified, with the pandemic exposing the dangers of over-dependence on a single vendor or geography. Traditionally, businesses have prioritized suppliers that provide consistent quality at the lowest price, but will now have to consider additional parameters. For their part, logistics companies will have to create networks that allow them to tap more sources and minimize potential points of failure.

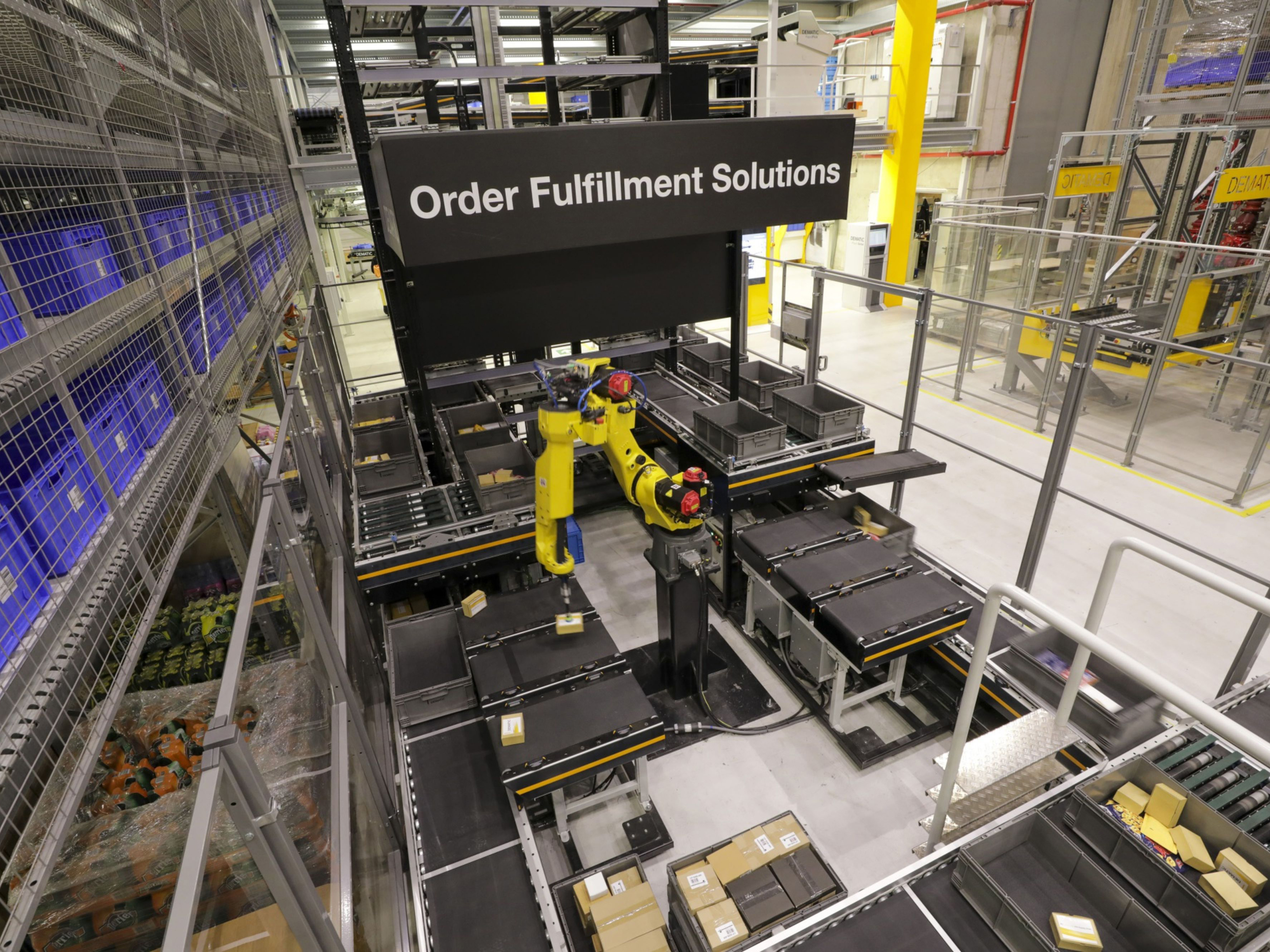

- Embracing technology. The pandemic has caused an unprecedented push for technology adoption across traditionally technology-shy segments. Logistics companies that earlier dismissed digital tools such as electronic-signature software and shipment-tracking apps as non-essential expenses need to take a fresh look at what digital can offer. Jordan Speer, research manager for global supply chain with IDC, believes this is a time of opportunity for many technologies that were poised to take a leap forward, such as 3-D design and printing, autonomous mobile robots, and blockchain. Logistics companies should also upgrade to systems that bring new levels of resilience and efficiency, and allow for remote interaction.

- Making smarter use of data. Most organizations were caught unawares by the pandemic. Going forward, they’re likely to place more emphasis on collecting and analyzing data to improve operations and decision-making. One could take a lesson from AGCO, an American manufacturer of agricultural equipment, which managed to stay ahead of the pandemic with a supply chain that included risk-notification and visualization capability, triggering alerts about unusual material flow from suppliers across the globe. As a result, the company was able to predict shutdowns and plan shipments in time to keep the business running.

Ambeshwar Nath is senior vice president of retail, CPG and logistics at Infosys.